Our Esg Ideas

Wiki Article

Everything about Esg

Table of ContentsNot known Details About Esg Technology The smart Trick of Esg Sustainability That Nobody is Talking AboutNot known Factual Statements About Esg Investing The 9-Minute Rule for Esg Investing

Why do particular investments execute better than others? Why do particular start-ups appear to always outshine and also obtain ahead of the associate? The response has 3 letters, and it is Whether you are an investor or a business, huge or tiny - Environmental, Social as well as Administration (ESG) coverage as well as investing, is the structure to capture on if you intend to remain up to speed with the market (and also your bill) - ESG.Now, allow's dive into the ESG subject and the excellent significance that it has for companies and financiers. To aid investors, economic organizations, and business recognize much better the underlying standards to execute and report on them, we developed a. Download the form below as well as access this unique ESG resource totally free.

Capitalists need to know if they can trust the firm as well as what sort of choices are taken behind closed doors. It consists of executive pay, sex equity/ equal pay, bribery and corruption, and also board diversity. The method of ESG investing began in the 1960s. ESG investing advanced from socially responsible investing (SRI), which left out supplies or entire sectors from investments associated to service operations such as tobacco, weapons, or items from conflicted areas.

It imposes required ESG disclosure commitments for property supervisors and various other monetary markets participants with substantive stipulations. A significant policy goal by the European Union to promote lasting financial investment throughout the continent. Parts of it are effective from March 2021. The purpose is to reorient capital circulations towards lasting financial investment as well as far from markets adding to climate change, such as fossil fuels.: is probably one of the most ambitious message aiming to give a non-financial overall score covering all facets of sustainability, from ESG to biodiversity and also pollution treatment.

Fascination About Esg Strategy

You instead leap on this train if you do not want to be left behind. For companies to remain ahead of policies, competition as well as unleash all the advantages of ESG, they need to incorporate this structure at the core of their DNA.

(ESG) concerns are playing a boosting duty in companies' choices around mergers, acquisitions, and divestitures. However how do these factors link to business performance and deal prospective? In this episode of the Within the Strategy Space podcast, 2 experts share their understandings on navigating this fast-changing landscape. Sara Bernow, that leads Mc, Kinsey's operate in sustainable investing and also co-leads the institutional investing technique in Europe, is a co-author of ESG the current article, "Greater than values: The values-based sustainability reporting that capitalists desire." Robin Nuttall leads our regulative as well as government affairs technique and recently co-authored "5 means that ESG produces value." They talked with Method & Corporate Financing interactions director Sean Brown at the European 2020 M&A Seminar in London, which was held by Mc, Kinsey and Goldman Sachs.

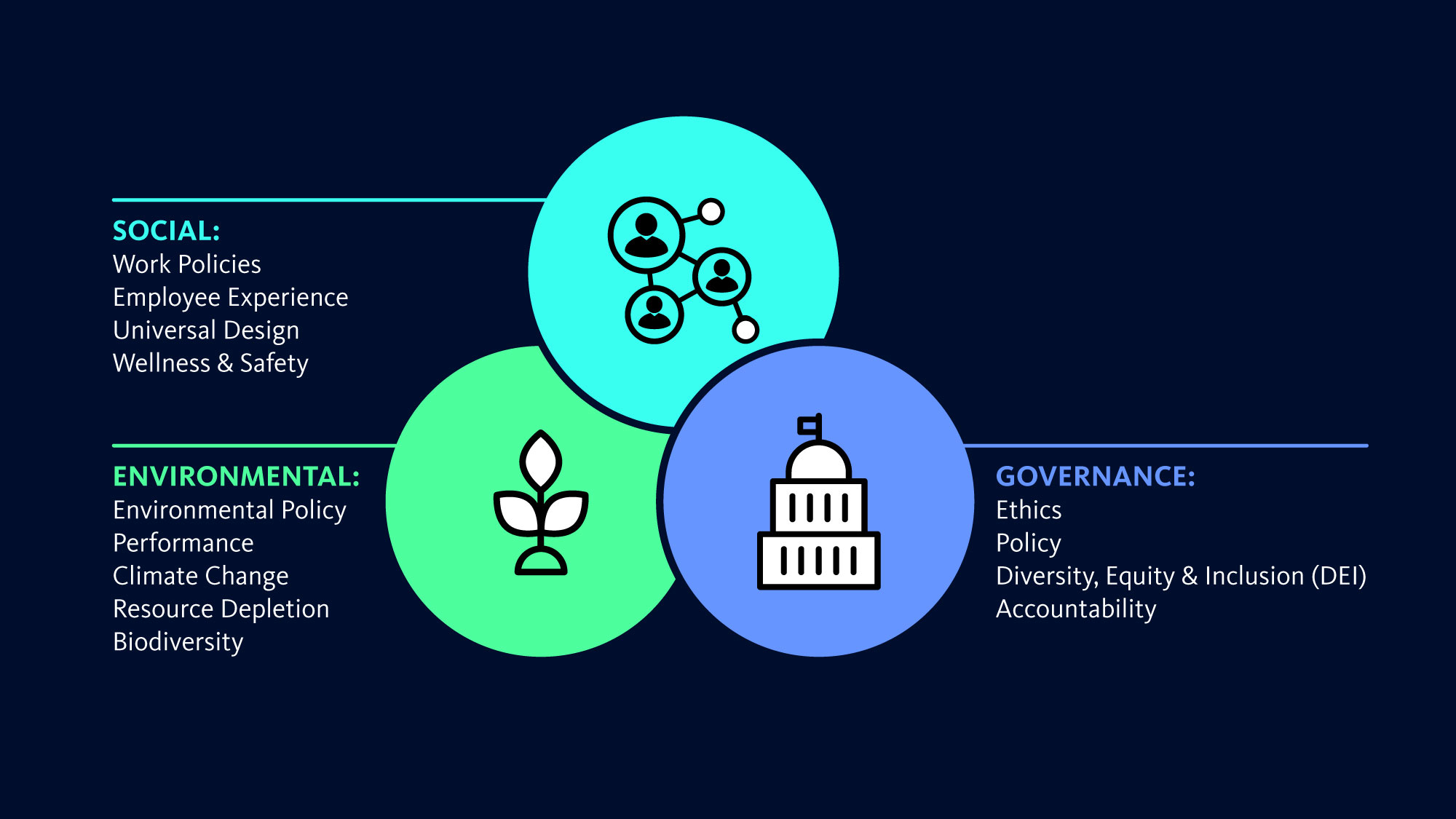

For even more discussions on the strategy issues that matter, subscribe to the collection on Apple Podcasts or Google Play - ESG. Audio Why ESG is below to remain Sara, could you begin by clarifying what ESG is and why it has risen in significance in M&A? ESG is rather a broad collection of concerns, from the carbon dioxide impact to labor practices to corruption.

Some Known Details About Esg

Why are those 3 problems organized together when they are so substantially different? They connect with each other in the feeling that the setting, the social aspects, as well as the level to which you have excellent administration impact your certificate to run as a company within the external world. To what extent do you handle your environmental footprint? To what extent do you enhance variety? To what extent are you clear in your contributions to a country? That has an effect on your permit to run psychological of the stakeholders around you: regulators, governments, and increasingly, NGOs powered by social media sites.Customers are currently demanding high requirements of sustainability and quality of work from companies. Regulators and also plan makers are extra curious about ESG because they require the company market to assist them fix social problems such as ecological pollution and work environment diversity (ESG Investing). The financier neighborhood has additionally ended up being a lot more interested.

So, taking an industry-by-industry lens is critical and we currently see ESG-scoring firms constructing deeper industry-specific point of views. What are a few of the key components on which ESG ratings have an effect? The initial question you require to answer is, to what extent does good ESG equate into excellent financial efficiency? On that, there have actually been even more than 2,000 academic researches and around 70 percent of them discover a favorable connection in between ESG scores on the one hand and financial returns on the other, whether determined by equity returns or profitability or assessment multiples.

What Does Esg Sustainability Mean?

Proof is emerging that a far better ESG score translates to concerning a 10 percent reduced cost of funding as the threats that affect your service, in regards to its permit to operate, are reduced if you have a strong ESG recommendation. Proof is emerging that a far better ESG rating translates to about a 10 percent reduced cost of funding, as the dangers that impact your service are decreased.Report this wiki page